NEW! Farmland Preservation Program Legislative Updates

On December 6, 2023, Governor Evers signed Assembly Bill 133, now Wisconsin Act 42, which makes changes to farmland preservation agreements minimum term lengths and increasing farmland preservation tax credits for all current participants. These changes go into effect starting on December 8, 2023 and will affect tax credit claims beginning tax year 2023.

Check out the Legislative Updates to the Farmland Preservation Program handout for more information.

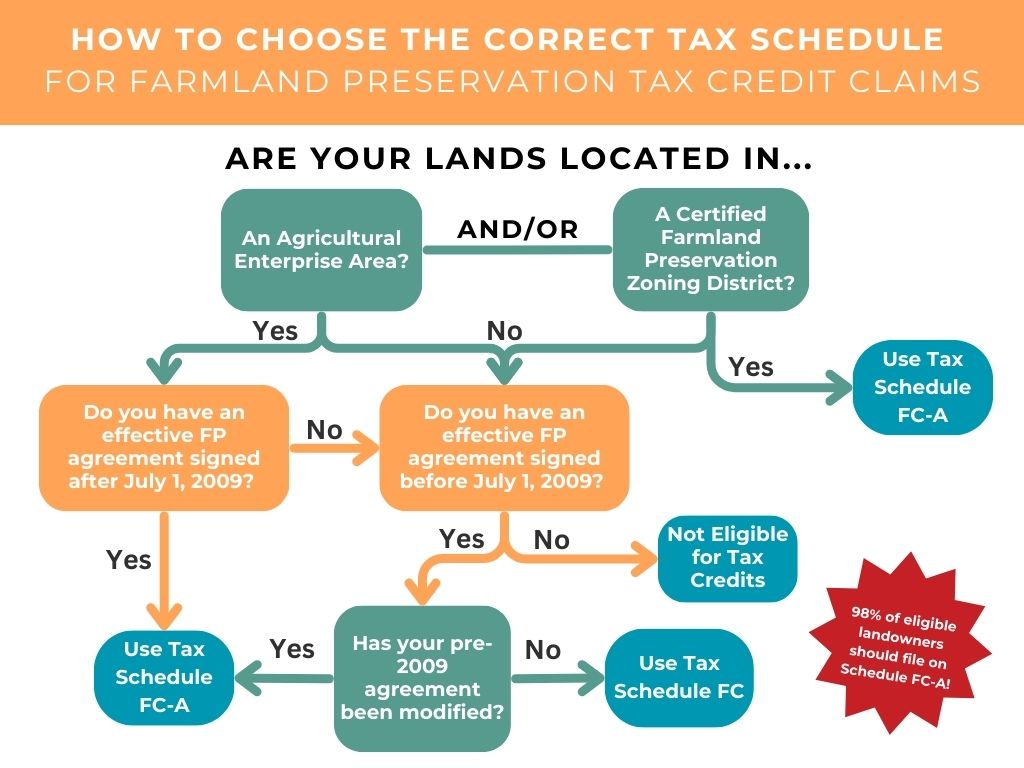

Which Tax Schedule should I use for my client?

What are the eligibility requirements to claim the farmland preservation tax credit under tax schedule FC-A?

A landowner may be eligible to claim under Schedule FC-A if:

- They are Wisconsin residents. A corporation claiming the credit must be incorporated under Wisconsin laws.

- Their land is located in a certified farmland preservation zoning district, covered by a farmland preservation agreement signed or modified after July 1, 2009, or both.

- Their land produced at least $6,000 in gross farm revenue in the previous year or $18,000 in the previous three years. Gross farm revenue may not include rent receipts.

- The previous year's property taxes are paid in full.

- They have a certificate of compliance from the county land conservation committee. After tax year 2016, landowners will have to list their certificate of compliance number on FC-A when filing their claim. Landowners should contact their county land conservation department if they need a copy of their certificate of compliance.

What should be attached to the claim?

For claims made on Schedule FC:

- Copy of FP agreement

- If land was bought or sold during the year, include closing statement signed by buyer and seller along with deed or land contract

- Documentation of percentage of ownership

- If any of the current tax year's property tax bills show unpaid taxes, need statement from county treasurer that the previous year's property taxes were paid in full

For claims made on Schedule FC-A

- Copy of FP Agreement (if applicable)

- If land was bought or sold during the year, include closing statement signed by buyer and seller along with deed or land contract

- Documentation of percentage of ownership

- Property tax bills for the applicable tax year

- A copy of the Certificate of Compliance if it is the first year issued and/or if the acreage on which the claim is based has changed (i.e. sale or purchase of land)

Can my client claim on land under Managed Forest Law (MFL)?

Under schedule FC, a landowner may not claim the farmland preservation tax credit on lands enrolled in MFL.

Under Schedule FC-A, a landowner may claim the farmland preservation tax credit on lands enrolled in MFL if the land is located in a certified farmland preservation zoning district or covered by a farmland preservation agreement signed or modified after July 1, 2009.

Can my client claim the Homestead Credit or Veterans and Surviving Spouses Tax Credit?

In order to claim the farmland preservation tax credit, an individual (and if applicable, the individual's spouse) must not claim homestead credit or veterans and surviving spouses tax credit for the same filing year.

What is a Certificate of Compliance?

Landowners may not claim the farmland preservation credit unless they certify on their tax returns that they are in compliance with state soil and water conservation standards. Beginning with tax year 2016, landowners need to list their certificate of compliance number on Schedule FC-A to demonstrate that they are in compliance. If a claimant is found to be out of compliance with the standards, the claimant must take action to address the issue identified or they may be issued a notice of noncompliance by the county.

Notices of noncompliance are submitted to the Department of Revenue and inform the department that an individual or entity is not eligible to claim the credit. A notice of noncompliance may be cancelled if the landowner comes back into compliance.