Eligible landowners may claim farmland preservation tax credits. The amount of the tax credit depends upon how a landowner participates in the program.

Landowners who are new to the program or need to obtain a copy of their Certificate of Compliance must contact the County Land Conservation Department in the County their farmland is located.

NEW! Farmland Preservation Program Legislative Updates

On December 6, 2023, Governor Evers signed Assembly Bill 133, now Wisconsin Act 42, which makes changes to farmland preservation agreements minimum term lengths and increasing farmland preservation tax credits for all current participants. These changes go into effect starting on December 8, 2023 and will affect tax credit claims beginning tax year 2023.

Check out the Legislative Updates to the Farmland Preservation Program handout for more information.

What are the eligibility requirements for claiming the credit?

The following requirements must be met to claim the farmland preservation tax credit under FC or FC-A:

- The landowner must have been the owner of the farmland for the year in which the credit is claimed of lands located in a certified farmland preservation zoning district, enrolled in an effective farmland preservation agreement or both. The landowner need not be the farm operator and may rent the land to a farmer.

- The landowner must have been a resident of Wisconsin for the entire taxable year.

- The landowner may not have claimed homestead credit or veterans and surviving spouses property tax credit for that year.

- The farm must meet applicable state soil and water conservation standards. For exact requirements, contact the county land conservation department in which the land is located.

County Conservation Department Directory

- The land produced $6,000 in gross farm revenue in the preceding year or $18,000 in gross farm revenue during the preceding three years. If a landowner rents the farmland, the landowner may claim on that land provided the renter meets the gross farm revenue requirement.

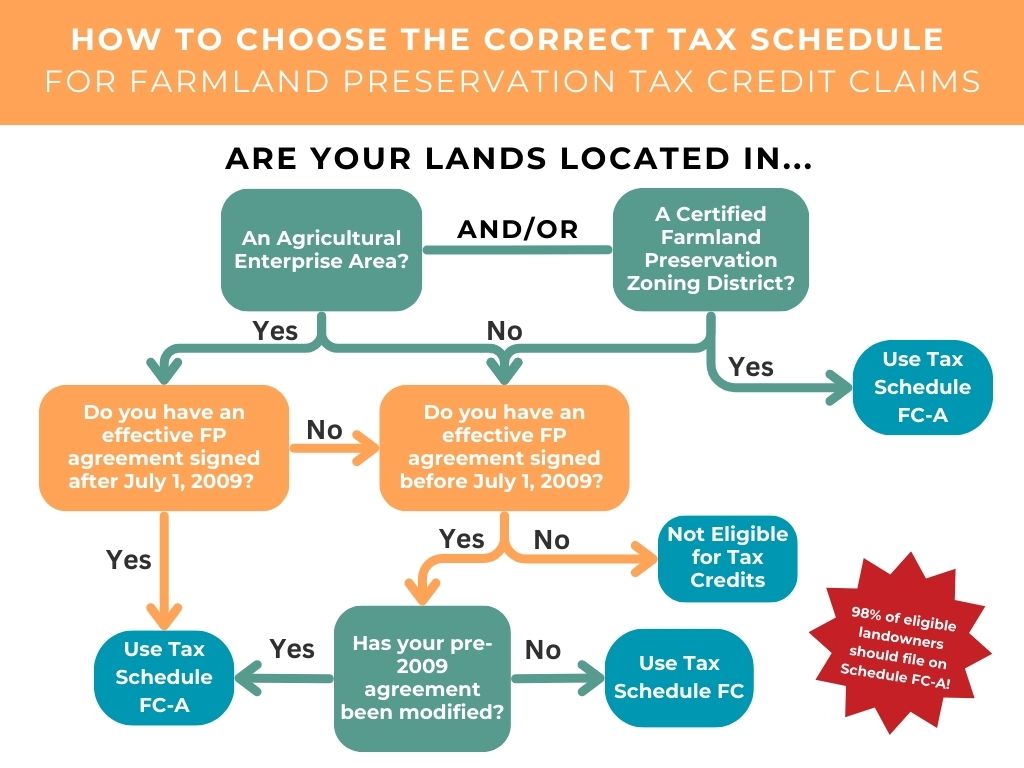

Which Tax Schedule should I use for my tax credit claim?

What level of tax credit may I claim on Tax Schedule FC-A?

Income tax credits available to landowners under FC-A are tiered based on the landowner's type of participation in the farmland preservation program. Beginning in tax year 2023, the tax credit have been updated to the following:

- $10.00/acre for landowners with a farmland preservation agreement signed after July 1, 2009 and located in an agricultural enterprise area, or for landowners who have modified an agreement initially signed before July 1,2009

- $10.00/acre for landowners in an area zoned for farmland preservation

- $12.50/acre for landowners in an area zoned for farmland preservation and in an agricultural enterprise area with a farmland preservation agreement signed after July 1, 2009, or in an area zoned for farmland preservation and with a farmland preservation agreement modified after July 1, 2009

Claims made for year prior to tax year 2023 are subject to the old credit rates that are as follows:

-

$5.00/acre for landowners with a farmland preservation agreement signed after July 1, 2009 and located in an agricultural enterprise area, or for landowners who have modified an agreement initially signed before July 1,2009

-

$7.50/acre for landowners in an area zoned for farmland preservation

-

$10.00/acre for landowners in an area zoned for farmland preservation and in an agricultural enterprise area with a farmland preservation agreement signed after July 1, 2009, or in an area zoned for farmland preservation and with a farmland preservation agreement modified after July 1, 2009

Landowners claiming the credit under a pre-July 1, 2009 or 2009 WI Act 374 Farmland Preservation Agreement should use schedule FC.

Claiming Under a Pre-July 1, 2009 Farmland Preservation Agreement

In limited circumstances, landowners will claim the tax credit by filing Schedule FC. This credit is calculated with consideration of household income and property taxes. Only landowners with land covered by a farmland preservation agreement that was signed before July 1, 2009 will claim using Schedule FC.

Landowners with an effective farmland preservation agreement signed before July 1, 2009 may modify their agreement to become eligible for the per acre farmland preservation credit.

Sample of Pre-2009 Farmland Preservation Agreement

Helpful Resources

Farmland Preservation Tax Credit Update for 2021

Guide to Claiming the Farmland Preservation Tax Credit

Farmland Preservation Tax Credit Fact Sheet

List of local jurisdictions with certified farmland preservation zoning ordinances